We help our clients tell their equity story effectively.

In a highly competitive capital market, companies need to grab the attention of investors and communicate their equity story effectively. This maximizes corporate opportunities and helps anticipate potential threats in the current market environment.

Leveraging technology to understand market trends and conversations.

Thanks to the capabilities of AI, we can listen and understand the conversations being generated by key stakeholders in the financial markets. This enables us to create communication strategies that are tailor-made for each client. By incorporating creativity, we ensure that our clients achieve a more effective reach in the investment world.

We are a team specialized in capital markets and critical situations.

Our team of specialists has extensive experience in managing corporate operations and critical situations. We ensure our strategies are tailored to meet the specific needs of our clients.

Trends in Financial Communication

Our specialists

To get and maintain the right valuation, companies need to effectively manage critical corporate events such as mergers, acquisitions, IPOs, and shareholder activism.

Related capabilities

-

Read more

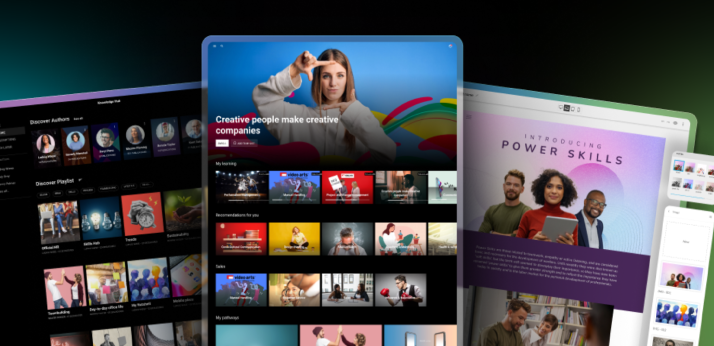

Talent engagement

We help companies attract, retain, and develop the best talent by turning communications into their strongest competitive advantage.

-

Read more

Sustainability & ESG

We ensure companies communicate their environmental management, social responsibility, and ethical governance performance in a transparent, credible way.

-

Read more

Crisis & Risk Management

By proactively mitigating potential reputational risks, we help ensure business continuity in times of crisis.

-

Read more

Corporate Communication

Our strategies establish companies and their executives as public opinion leaders while protecting their reputations.